State of Crypto Q4 2025: Younger investors are rewriting the investing playbook

For decades, the path to building wealth in America has looked roughly the same: get a good job, buy a home, invest in stocks, and let time do the rest. Our latest State of Crypto report suggests that younger investors no longer believe that playbook works for them, and they’re acting accordingly.

Coinbase partnered with Ipsos to survey 4,350 US adults, with a subgroup of 2,005 investors who have investment accounts, across generations to understand how they’re navigating today’s markets and what role crypto plays in their strategy. The headline: Younger investors (Gen Z and Millennials) are more hands-on, more open to non-traditional assets, and more likely to see crypto as a core part of their financial future than any generation before them.

A generation that feels locked out of the old wealth ladder

Younger investors are more optimistic about the economy than older investors, but they don’t think the system was built for them. Nearly 3 in 4 younger adults (73%) say it’s harder for their generation to build wealth through traditional means, compared with 57% of older adults.

They’ve watched housing become less affordable, student debt rise, and wage growth lag. As a result, they’re much more likely to say they’re “looking for alternative ways to build wealth” beyond the classic combo of home equity and stock portfolios.

Three times the allocation to non-traditional assets

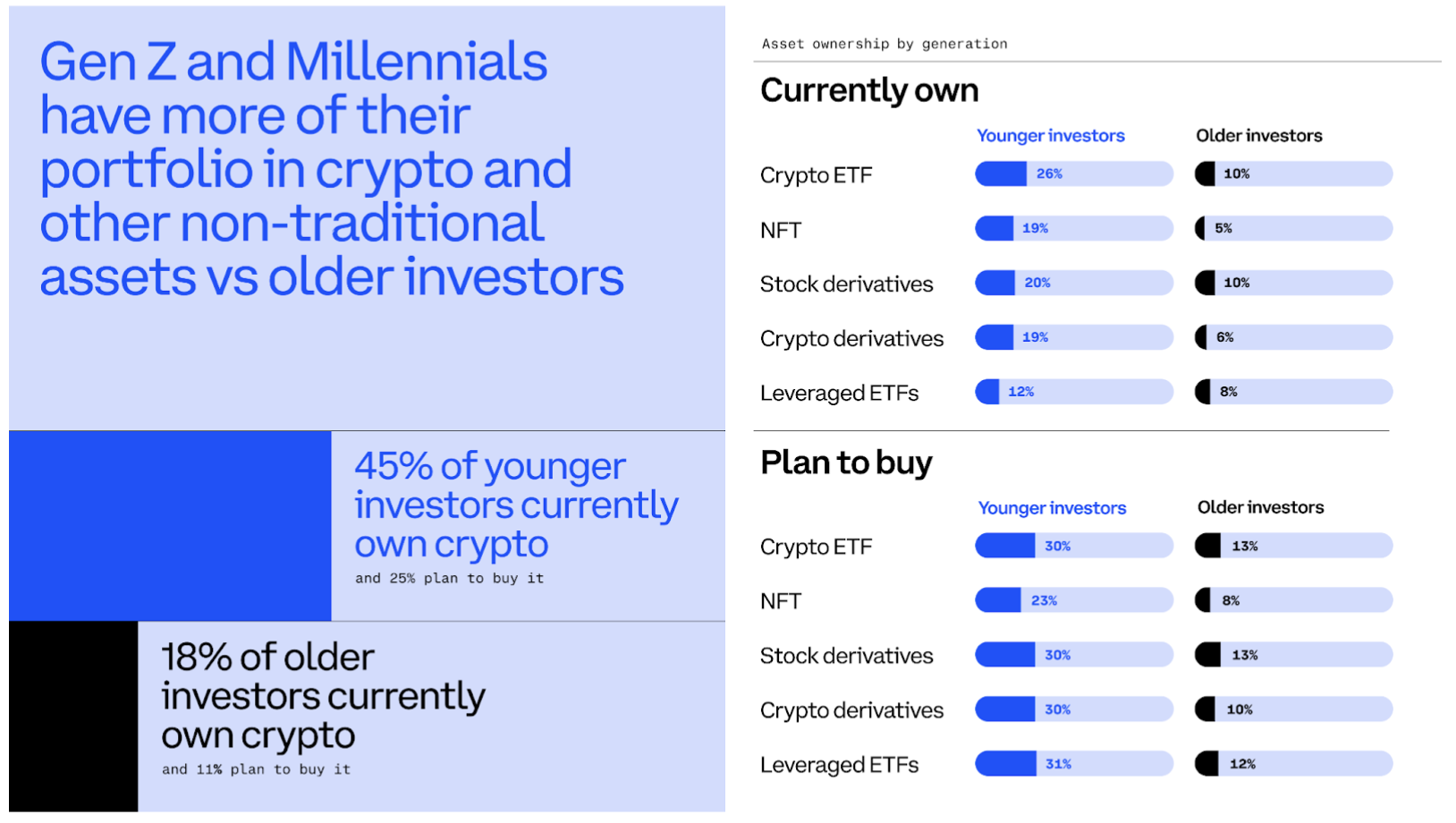

That frustration is showing up directly in how they allocate capital. Younger investors report that 25% of their portfolio is in non-traditional assets, things like crypto, derivatives, NFTs, and other emerging products. That is 3x the allocation of older investors, who report just 8% of their portfolio in non-traditional assets.

Stock ownership is roughly similar across generations. The difference is what younger investors layer on top. They are more likely to say they’re actively looking for ways to earn rewards beyond traditional stock dividends, and they’re more willing to experiment with new tools and new markets if it means a better shot at closing the wealth gap.

Crypto is not a side bet, it’s central to their strategy

Nowhere is this generational shift clearer than in crypto adoption. According to the report, 45% of younger investors say they already own crypto, compared with 18% of older investors. And nearly 1 in 2 (47%) younger investors say they want access to new crypto assets before the general market, versus just 16% of older investors.

For this cohort, crypto isn’t just a speculative trade, it’s part of how they believe they can catch up. Four in five younger adults say that cryptocurrency gives people in their generation more financial opportunities than they would otherwise have. The same share (4 in 5) believe that crypto will play a much larger role in the financial system in the future; among older investors, that drops to about 3 in 5.

This appetite for new markets doesn’t stop at spot crypto, they want more non-traditional assets. Data reveals 4 in 5 younger investors say they are willing to try new investment opportunities before others do, compared to just under 1 in 2 of older adults. Younger investors are consistently more interested in emerging non-traditional products like crypto derivatives, prediction markets, 24/7 stock trading, early-stage token sales, altcoins, and DeFi lending.

What this means for the future of markets

Put simply: the younger investor is different. They’re trading more often, taking more risk in pursuit of higher returns, and moving a meaningful share of their portfolio into non-traditional assets, with crypto at the center. They’re also pushing the industry toward platforms that are always on, support a wider range of assets, and feel more native to an internet-first generation.

In order to meet the needs of the emerging investor, Coinbase is building the Everything Exchange, a place to trade anything, anywhere, anytime, while continuing to prioritize security, compliance, and responsible innovation.