Consumer Protection Tuesday: How Coinbase Safeguards PII Using MPC Encryption

Coinbase and CoinTracker Simplify Crypto Taxes Ahead of the New Form 1099-DA

Beginning with tax year 2025, some U.S. customers will receive a new IRS form, Form 1099-DA, which reports the proceeds from digital asset sales and/or exchanges.

Introducing Coinbase Token Manager: The Next Evolution of Liquifi

TL;DR: Liquifi is rebranding as Coinbase Token Manager, a comprehensive platform to simplify and scale token management. Coinbase Token Manager will help teams manage token cap tables, automate vesting and distribution, and streamline compliance, while seamlessly integrating with Prime’s institutional grade custody solution.

A Dedicated Architecture for Solana at Coinbase

Tl;dr: To meet the scaling demands of Solana, Coinbase has moved away from its legacy chain-agnostic processing model. We engineered a dedicated, high-throughput streaming architecture with parallel block processing, resulting in a 12x increase in transaction processing throughput and a 20% reduction in deposit latency.

From Intuition to Precision: How Coinbase Built a General-Purpose Targeting Engine

We built Smart Targeting to move beyond using manual segmentation to build target audiences towards automated, intelligent discovery.

How Coinbase Is Helping the Financial World Stop Cybercriminals in Their Tracks

Consumer Protection Tuesday: What Are Wallet Drainers and How Can You Stay Safe?

Coinbase Establishes Independent Advisory Board on Quantum Computing and Blockchain

Consumer Protection Tuesday: Who’s Behind All These Scams? Inside The World of Organized Fraud

Bridging the Capital Chasm: Unlocking Wealth Creation

A new paper from the Coinbase Institute, From the Unbanked to the Unbrokered: Unlocking Wealth Creation for the World, highlights how to close the capital chasm.

Consumer Protection Tuesday: Five New Year’s Resolutions for Digital Safety in 2026

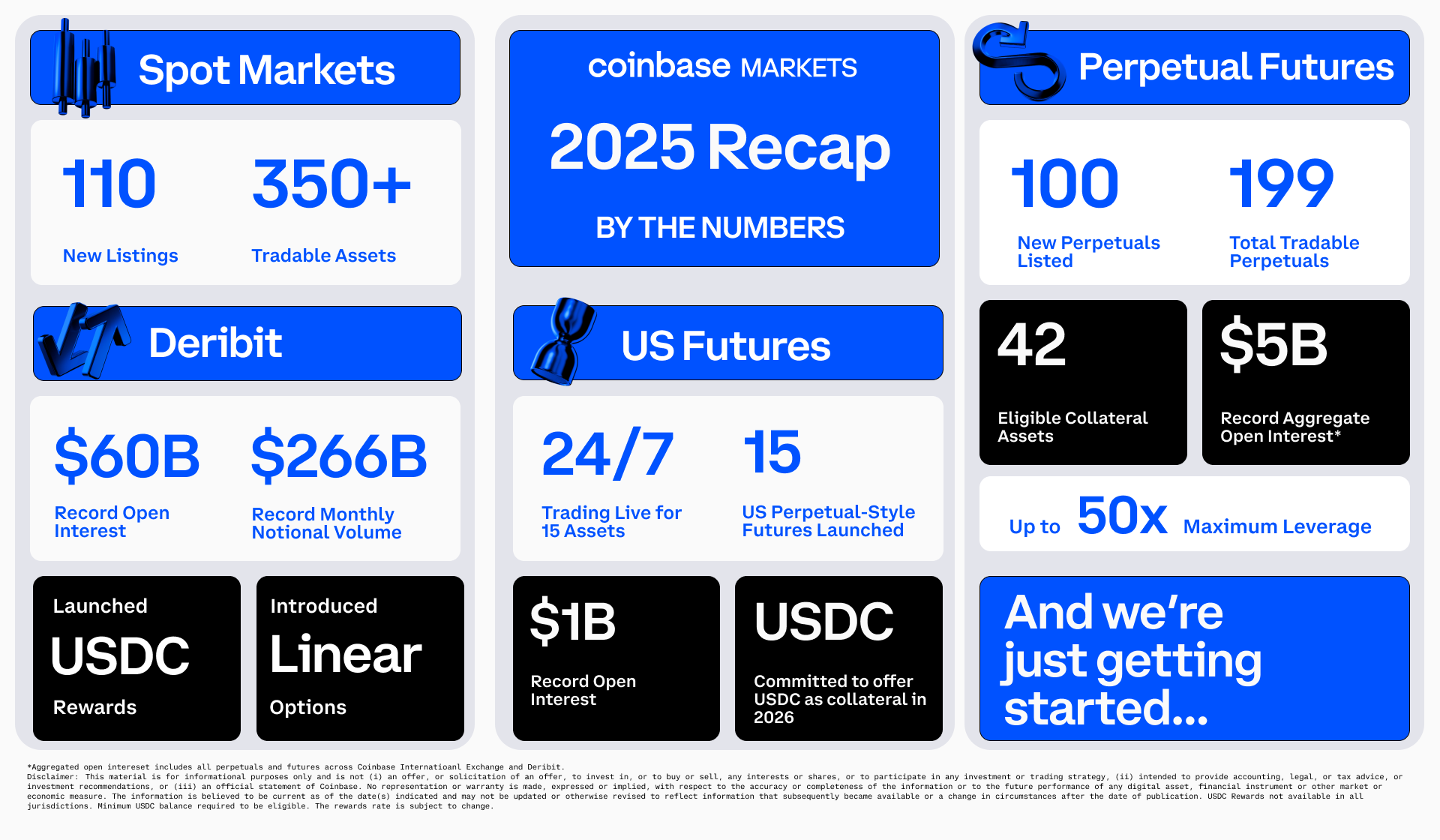

2025 in Review: A Breakout Year for Coinbase Markets

2025 was a landmark year for Coinbase Markets.

Coinbase to acquire The Clearing Company: Powering the future of prediction markets

Coinbase has entered an agreement to acquire The Clearing Company, a prediction markets company innovating at the frontier of regulated, onchain markets. The team brings deep expertise that will help power and scale prediction markets on Coinbase.

Building enterprise AI agents at Coinbase: engineering for trust, scale, and repeatability

Working with the Brooklyn DA to support victims and help bring an alleged scammer to justice

Create your own stablecoin with Coinbase

TL;DR: Coinbase is launching Custom Stablecoins, allowing any business to create a custom stablecoin fully backed 1:1 by flexible collateral (including USDC), all custodied by Coinbase.

Disclaimers: Derivatives trading through the Coinbase Advanced platform is offered to eligible EEA customers by Coinbase Financial Services Europe Ltd. (CySEC License 374/19). In order to access derivatives, customers will need to pass through our standard assessment checks to determine their eligibility and suitability for this product.